Latest News

IRS Estate Audits

The Federal estate tax is a tax on the transfer property at death. It is applied to estates for which at-death gross assets, the “gross estate”, exceeds the filing threshold. Included in the gross estate are real estate, cash, stocks, bonds, businesses, and decedent-owned life insurance policies. Deductions are allowed for administrative expenses, indebtedness, taxes, casualty loss, and charitable and marital transfers. The taxable estate is calculated as gross estate less allowable deductions.

Highlights of the Data

The number of estate tax returns declined over 67 percent from 38,000 in 2007 to 12,411 in 2016, the latest year of available data. This was primarily due to the increase in the filing threshold from $2.0 million in 2007 to $5.45 million in 2016.

Stocks and real estate made up over half of all estate tax decedents’ asset holding in 2016. Estate tax decedents with total assets of $20 million or more held a greater share of their portfolio in stocks (over 44%) and lesser shares in real estate and retirement assets than decedents in other total asset categories.

Results of Estate Audits

Estate examined received refunds 19% of the time in 2016. Twenty-one percent of estate audits had no changes and 60% resulted in additional tax owed.

Consider in 2016, the implications of how estate cases have been resolved in IRS examinations. According to our source, they expect 2017 results to be similar.

Chances of an Audit by the IRS

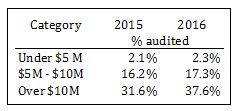

The following table presents the percentage of audited estate returns. There were 35,619 and 36,130 estate tax returns filed in the respected years shown in the table below.

How can American Business Appraisers Help?

To limit IRS scrutiny on a business valuation developed to support the stock values of decedents assets requires a significant amount of careful consideration. There are certain rules and regulations that an appraiser must follow, otherwise the appraiser can receive a monetary penalty. Call us to discuss any specific valuation needs. Every individual situation is different and not everyone requires our certified appraisal services and sometimes just talking with one of our appraisers is all that may be necessary. With our initial consultation, there is no cost or obligation to you. We promise you two things; first, to invest a reasonable amount of time to gain an understanding of your specific requirements, and second, our communication will be kept confidential.