Latest News

Very Basics of Business Valuation

The term “value” means different things to different individuals. I’m not sure who made that statement many years ago, but it still holds true today. The perceived value depends on the interpretations, circumstances and role of the shareholder(s). Without carefully defining the term “value”, a conclusion reached in a valuation report will have no meaning. If the objective in the valuation process is to determine fair market value, it must be defined in the appraisal report as not to mislead the reader.

The most important part of the business valuation process involves the determination of the available cash flow the business generates. Considering whether to use a historical or projected earnings stream will depend on various factors, such as, the use or purpose of the valuation assignment. Oftentimes, for divorce and buy/sell assignments, the use of historical financial data is probably more appropriate, as it is based on actual events which have occurred. However, investment decisions are based on the prospect of future benefits or the anticipation of benefits – so a projected earnings stream may be more suitable.

Commonly used earning streams are:

- Seller’s Discretionary Earnings (SDE)

- Earnings before Interest, Taxes, Depreciation & Amortization (EBITDA)

- Earnings before Interest and Taxes (EBIT)

- Pre-Tax Earnings (EBT)

- Net Income (after-tax)

- Net Cash Flow (dividend-paying capacity)

Net cash flow is the preferred income stream because it is the best proxy of the financial return to an investor in the stock of the Company. In addition, net cash flow is conceptually preferable because most of the capital market data used to develop discount rates is related to net cash flow. Net cash flow can be determined on either an “equity” capital basis or an “invested capital” basis.

Valuation Approaches & Methods

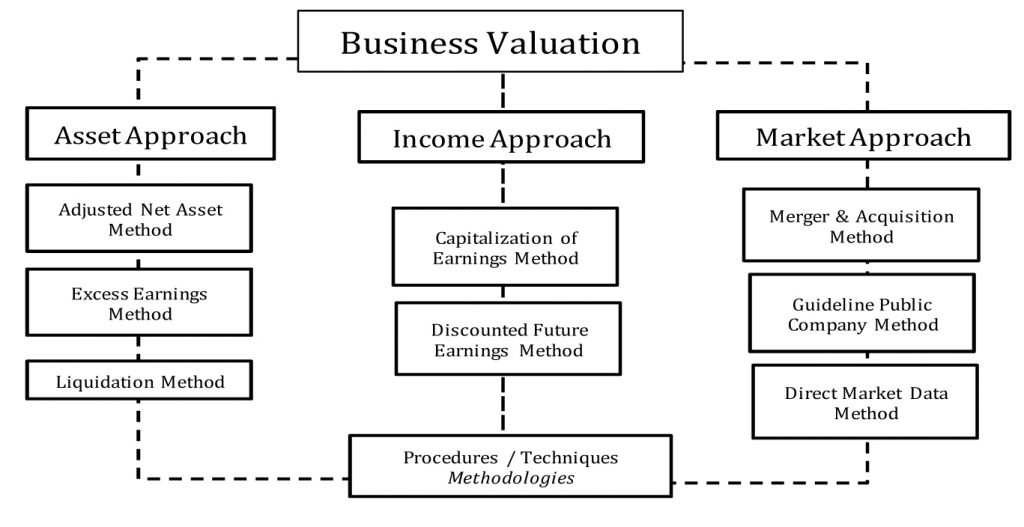

There are distinct differences between approaches and methods. There are conceptually three broad approaches in business valuation: the asset, income, and market approaches. Various methods are available under each approach as presented in the diagram.

One of these methods is earnings driven; one is market driven; and the other utilizes the assets of the Company to determine value. The earnings driven method is typically more appropriate, because it accords primary consideration to the historical/future earnings potential of the Company.

One of these methods is earnings driven; one is market driven; and the other utilizes the assets of the Company to determine value. The earnings driven method is typically more appropriate, because it accords primary consideration to the historical/future earnings potential of the Company.

In concept, a market driven method follows the goal in the appraisal process, which is to estimate what could reasonably be expected to occur in the market, as it is based on what has occurred in the market. Its limitations are the extent to which data is available on transactions and the imprecision associated with determining the extent to which the companies sold were sufficiently similar to be judged “equally desirable substitutes”.

Asset-based method provides an alternative method, but one which is less appropriate for primarily two reasons: (i) the business valuation community is in agreement that earnings should be pre-eminent; and (ii) adjustments made to the balance sheet are less precise, particularly regarding valuing the fixed assets.

How can American Business Appraisers Help?

Business valuations require a significant amount of careful consideration and judgment. Our experienced staff recognizes and quantifies a business’ risk factors and value drivers. The more risk factors a business has, value is driven downward. On the other hand, identifying value drivers will increase the value of a business.

Call us to discuss any specific valuation needs. Every individual situation is different and not everyone requires our certified appraisal services and sometimes just talking with one of our appraisers is all that may be necessary. With our initial consultation, there is no cost or obligation to you. We promise you two things; first, to invest a reasonable amount of time to gain an understanding of your specific requirements, and second, our communication will be kept confidential.